When you build your investment portfolio, you’ll likely decide on a specific asset allocation that’s appropriate for your financial goals, risk tolerance and time horizon. But as time passes, certain investments will have higher returns than others, and therefore will begin to take up a more significant percentage of your portfolio.

For example, you may decide on an asset allocation of 60% stocks and 40% bonds. But in a bull market, your stock investments are likely to perform far better than your bond investments. The next time you check in on your portfolio, you might find that stocks now make up 70% of your portfolio, while bonds only make up 30%.

That’s where portfolio rebalancing comes in.

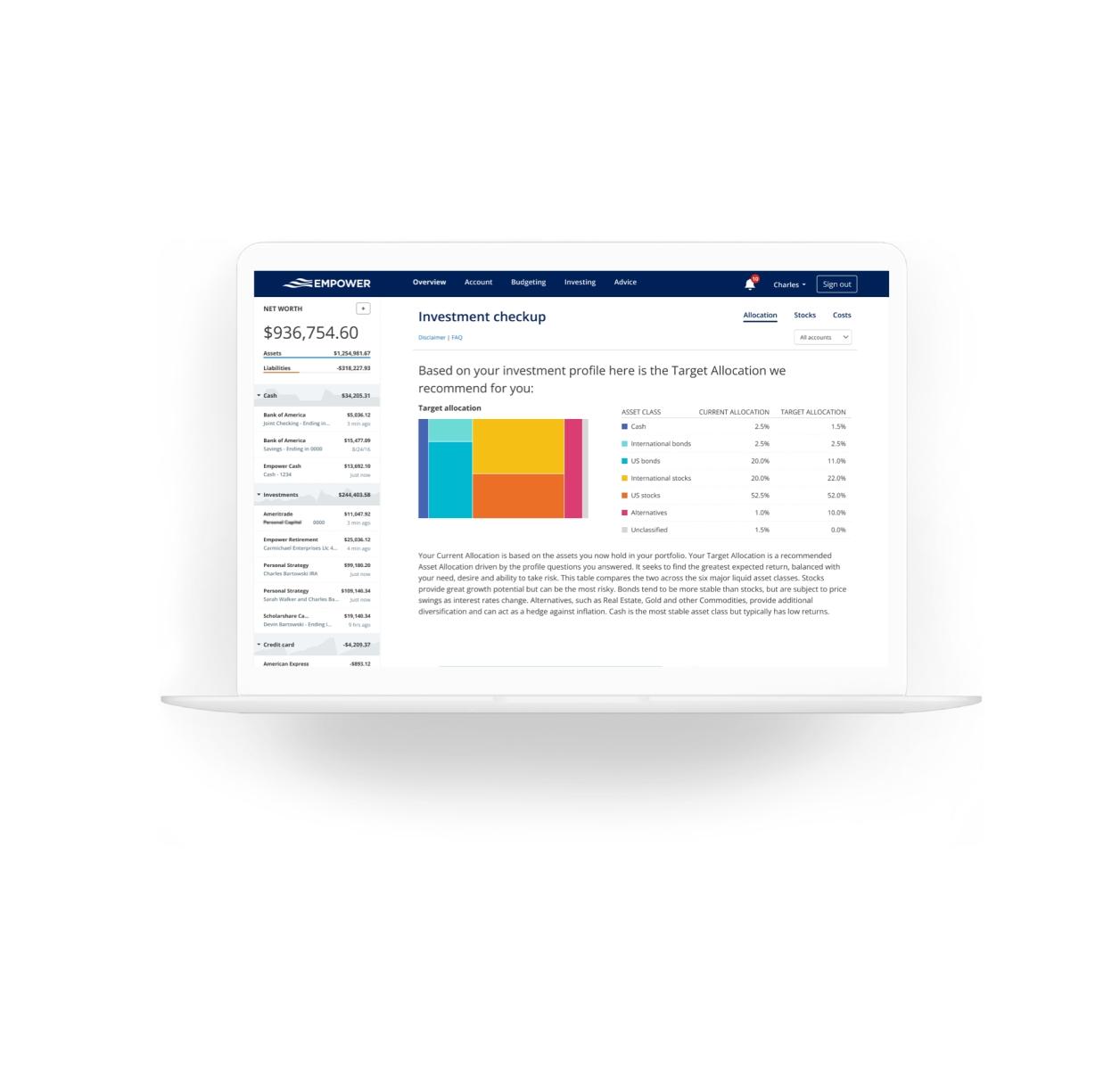

Portfolio rebalancing is the process of changing your asset allocation to get back to your target portfolio. There are a couple different ways you can realign your asset allocation for your financial goals: